How to Choose a Health Care Proxy for a Loved One with Dementia

When helping a loved one with dementia, you may face many difficult choices. Often, a person with dementia needs medical care and possibly assisted living or nursing home care. This ...

When helping a loved one with dementia, you may face many difficult choices. Often, a person with dementia needs medical care and possibly assisted living or nursing home care. This ...

This is a common question from families working to learn more after an Alzheimer’s or dementia diagnosis. Alzheimer’s is the most common form of dementia, but dementia includes many other ...

If you’ve managed to keep Mom at home—bravo. That’s an accomplishment that deserves real recognition. Supporting a loved one as they age, especially in the comfort of their own home, ...

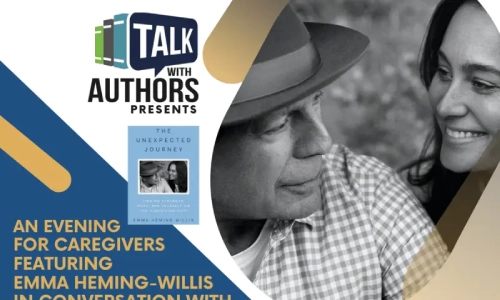

You’re Invited—An Evening for Caregivers with Emma Heming Willis and Anderson Cooper At Van Dyck Law Group, we are proud to advocate for those who dedicate their lives to caring ...

Protecting against elder financial abuse in dementia cases is a moral imperative, and addressing the threat such abuse presents is a critical aspect of elder care. In this blog post, ...

Dementia is a progressive condition that affects memory, thinking, and behavior, challenging both those who live with it and their families. A well-crafted dementia care plan not only provides structure ...

Dementia is a complex condition that not only affects the cognitive abilities of an individual but also has profound implications for legal affairs and family dynamics. Early recognition of dementia’s ...

Dementia is a complex condition that not only affects memory and cognition but also influences an individual’s ability to make informed decisions. Navigating the intersection of legal capacity and dementia ...

A dementia diagnosis can be a terrible thing to face, both emotionally and practically. It brings uncertainty about the future, making estate planning an urgent and essential step. While facing ...

Early onset dementia refers to dementia diagnosed before the age of 65. Unlike typical dementia, which primarily affects older adults, early-onset dementia can impact individuals in their 30s, 40s, or ...

“It was a pleasure working with Van Dyck Law & all of the associates I came into contact with. Everyone was efficient, professional and nice to work with. Fiona is wonderful to work with, as well as her staff.”

“Fiona is personable and presented hard to talk about Estate Planning, Trusts, Wills in a clear and understandable manner. She is well-informed and recommended highly by my husband and I. Her staff is just as personable and well versed in the Estate, Trusts, Will’s areas of law.”

"Fiona is professional and highly knowledgeable, but what sets her apart is her her ability to explain complex legal details in an easy to understand manner. She is friendly and patiently answered our many questions thoroughly. Her staff is equally friendly and responsive. And they accomplished all of this under virtual conditions! Very pleased with our experience."

"*" indicates required fields

© 2022-2026 copyrights Van Dyck Law Group. All Rights Reserved.